Hopes of a green aluminum smelter restart in Whatcom County were dashed late last year, when the private equity firm pushing the restart backed out of negotiations to reopen the Intalco aluminum smelter.

Blue Wolf Capital, a New York-based private equity firm, cited high, volatile electricity rates and stagnant negotiations with utility provider Bonneville Power Administration as reasons to end talks of a restart.

In the weeks since negotiations halted, Washington senators and representatives have pushed alternative methods to restart the Whatcom County plant, seeking creative ways to bring back the 700 union manufacturing jobs lost when Intalco curtailed in mid-2020.

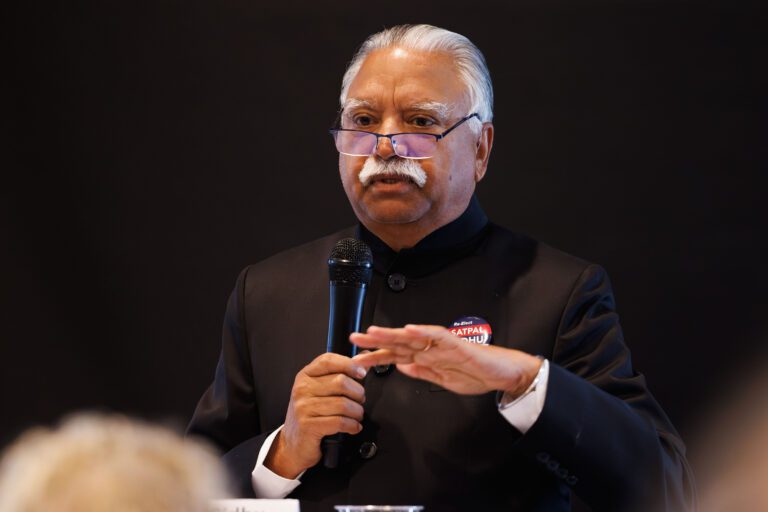

Local politicians such as U.S. Rep. Rick Larsen have zeroed in on the federal Defense Production Act of 1950 (DPA) as a possible reopening route.

“I am disappointed to learn this agreement could not be reached to reopen Intalco and bring more union jobs to Whatcom County,” Larsen told Cascadia Daily News in December. “I will continue to work with federal, state and local partners, labor and industry to help bring these jobs back to northwest Washington.”

In 2022, Larsen instructed his staffers to review the DPA, to see if it could be used to help restart the smelter.

“There’s a national security question about this,” Larsen said in early September during his endorsement interview with CDN. “Where do we get aluminum from, and where do we want to get it from?”

What is the Defense Production Act?

The DPA of 1950 is a federal law that allows agencies and presidents to require businesses to prioritize defense-related production. Title I of the bill authorizes the president to prioritize specific materials and services over others, and Title III allows the president to create economic incentives like grants, contracts and loans to “create, maintain, protect, expand or restore domestic industrial capabilities,” according to the Department of Defense (DoD).

The DPA has been implemented dozens of times since it was signed into law by President Harry Truman. Most recently, it was used by the Biden administration to “accelerate domestic manufacturing of clean energy,” in mid-2022. Before that, it was used by both the Biden and Trump administrations to compel car companies to produce ventilators and personal protective equipment in the early days of the COVID-19 pandemic.

Though the legislation includes several sections, Title I and Title III remain most relevant to restarting the smelter in the coming years.

How does the DPA apply to Intalco?

Historically, the DPA has predominantly impacted existing corporations, such as when it was used during the pandemic. That doesn’t mean it can’t support the restart of a curtailed facility.

A recent report from the DoD, “Aluminum Refining, Processing, and Manufacturing,” called the production of aluminum – specifically high purity aluminum – “critical to national defense,” and said it could use a bit of a boost from the DPA.

“The DoD believes that high purity aluminum (HPA) is critical to national defense, and due to the disruption to energy market, domestic industry is unlikely to maintain or sustain sufficient HPA productive capacity without DPA support,” the report detailed.

The report specified DPA support would be viable through Title III, where leaders could offer financial support and incentives to get the potlines rolling again.

Estimates put the price tag on an Intalco restart at around $175 million. Blue Wolf initially committed to spending the startup costs, but was hindered by variable electricity prices. With Title III, additional federal funds would be available for the restart.

In 1993, the United States had more than 20 active aluminum smelters. Today, only five remain operational, all of them east of the Mississippi River.

Why high purity aluminum?

Aluminum is the second-most consumed metal globally. It’s in cars, homes and airplanes. It’s in the cans that hold our food in the grocery store and our electricity transmission lines.

High purity aluminum is less common and contains low levels of iron and silicon. It’s heavily used in the production of tactical wheeled vehicles, combat vehicles, space launch systems and military aircraft, including the F-35 fighter jets being rolled out at military bases across the U.S.

But the smelter isn’t currently producing anything?

No, it’s not.

At this point, no one is struggling with access to aluminum, either, the DoD said.

“Due to the availability of aluminum metal from domestic sources (primary smelting and recycling) as well as imports from close United States allies (e.g., Canada), DoD has not found shortfalls for aluminum metal,” according to the December report.

Though aluminum is in high supply, high purity aluminum isn’t, and supply could be threatened. Because the only remaining non-U.S. high purity aluminum producers are in New Zealand, the United Arab Emirates, Russia and Canada, the DoD has identified domestic high purity aluminum production as critical.

With DPA funds, that high purity aluminum could be produced in Ferndale.