As Whatcom County emerges from the COVID-19 pandemic, Executive Satpal Sidhu has proposed an ambitious budget with increased spending and taxes in 2023 and 2024.

The county executive’s biennial budget proposal is Sidhu’s first opportunity to pursue new programs and expand county departments since he took office in early 2020.

“In 2020, we just took the past years’ budget and republished it,” Sidhu told the County Council on Oct. 25. “There was no time, at the COVID time, to rebuild the biennium budget.”

“It was so much uncertainty in 2020, we really couldn’t bring out a lot of different things,” he added.

Sidhu said he wants to spend remaining federal COVID-19 relief funds on expanded child care capacity, homeless services, relief for the backlog in the county courts, and $4 million for increased internet access in rural areas.

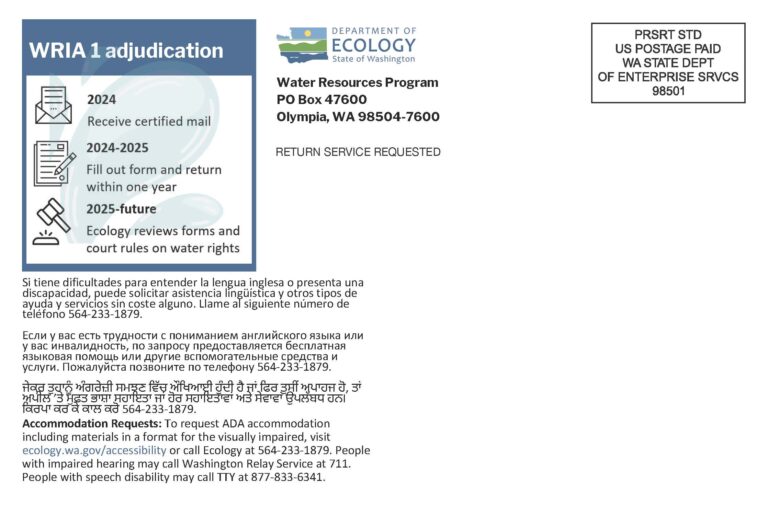

The executive proposes $200,000 for the new Whatcom Racial Equity Commission and $250,000 for a “water solutions table” that would bring together tribes, farmers and other parties to hammer out possible solutions to the county’s water supply problems. The solutions table would run parallel to water-rights adjudication, which is expected to commence in Whatcom County Superior Court next year, Sidhu said.

Sidhu also wants to restructure the salaries of county employees, in order to pay them better and improve retention.

The executive’s proposed budget continues the rapid growth of the Health Department that started with the onset of the pandemic. Of the 19 new “full-time equivalent” positions the executive would add to the county staff in the next biennium, 11 of them are in the Health Department. The size of the department has already increased by 41.6 positions from 2020 to 2022, or 47%.

Overall spending in the Health Department would decline 8% under Sidhu’s proposal, however, with 56% less spent in the department’s communicable diseases division.

The Public Works Department, which manages the county roads and flood control, adds five full-time positions in Sidhu’s budget. Spending at Public Works would increase 12% next year, with a 51% increase in the flood program.

Sidhu said the county flood tax must be raised to keep the program sustainable. He proposes an increase of 3 cents per $1,000 of assessed value, which would add $1.2 million of revenue next year. The flood tax rate is 11.9 cents per $1,000 in 2022.

The County Council will make the final decision on the budget, using the executive’s recommendation as a starting point.

Sidhu appealed to the council on Oct. 25 to accept his proposal for a 1% increase in property taxes next year. Along with new construction, the increase would bring an additional $662,000 in revenue. The council hasn’t raised property taxes in more than a decade, Sidhu said.

“I’m urging the council” to approve the tax increase, Sidhu said. “I didn’t use the word ‘recommending.’ I actually used the word ‘urging.’”

Council member Ben Elenbaas — who typically is wary of new taxes — criticized the proposed property tax hike in an interview.

“It has appeared to me in my time on the council that Executive Sidhu is incredibly out of touch with his constituents,” Elenbaas said. “Very poor timing, especially in respect to all the other taxes this administration is looking for at this time, and the economic reality of most people in Whatcom County right now.”

A month ago, the county notified property owners of their new assessed values for 2023, which will be 15% to 45% higher than this year across most of the county — and even higher, in some cases, in Blaine, Birch Bay and Point Roberts. Property values on average increased 25%, so people whose values increased more than that for 2023 will see higher taxes next year, even without Sidhu’s proposed increase.

The County Council scheduled a public hearing on the 2023–24 budget for 6 p.m. on Nov. 22.

This story was changed at 3:28 p.m. on Nov. 1 to provide more clarity about which property owners are likely to see higher property taxes in 2023.